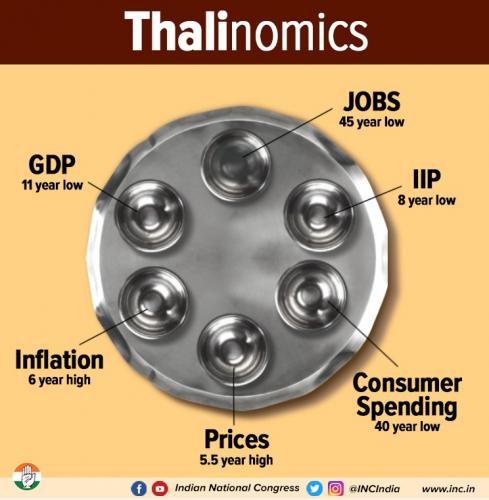

To begin with, the Finance Minister does not even recognise that the economy is experiencing a severe slow down! The budget is presented as if there is no slow down. Though she referred several times to the improvement in the ‘ease of business’ ranking of India, she made no mention about the increase in the incidence of poverty in the country or the increase in its corruption ranking or the very slow improvement in education and health or the decline in demand in the economy. If you do not accept the problem, how can you find a solution?

What is needed are demand side measures to raise effective demand in the economy. On the demand side, funds for agriculture have declined compared to the allocations in the last year; funds for education have not increased in real terms and MGNREGA funds also have declined by about 13 %. Again, the income tax relaxations that have been made will not increase demand as much.

The major problem today in the country is declining effective demand in the economy. However, this problem is not addressed effectively in the budget. The Finance Minister has done a lot for corporate sector companies, such as reducing the corporate tax to 15 %. This is one of the lowest rates in the world. Then dividend distribution tax is removed, capital gains tax and wealth tax are reduced; incentives and concessions for exports have increased, and relaxations are given to foreign investment; but these are all supply side measures. What is needed are demand side measures to raise effective demand in the economy. On the demand side, funds for agriculture have declined compared to the allocations in the last year; funds for education have not increased in real terms and MGNREGA funds also have declined by about 13 %. Again, the income tax relaxations that have been made will not increase demand as much, as the propensity to consume of the income tax payers (only 2 % of the population pays income tax today) is much less than the consumption levels of the bottom 40 per cent of the population. In short, the budget is not likely to push the effective demand substantially in the economy.

Again, food subsidies have declined, The drop in food subsidies may also reduce the consumption levels of the bottom 40 per cent of the population. The budget refers to the Kisan Sanman Yojana, but data shows that after the first instalment (which also did not reach all the farmers) the coverage has reduced and today only about 25 % of the farmers have received the third instalment. This also brings us to a very important point that there are hardly any third party evaluation studies done of these new programmes and schemes by the government. Such studies could have helped the government a lot!

Another problem with the policies is that the bottom 30 to 40 % of the population is more or less left out. The rural wages and particularly agricultural wages have declined leading to reduced consumption. However there is no move to raise their wages. When government employees get allowances for all rises in prices, the minimum wages are not raised. These rural wage earners are least educated and suffer from poor health. Programmes for farmers do not reach them. They are virtually excluded from the development process. They are also very distanced from high technology. Artificial intelligence, robotics, 3-D printing and other high tech that the government wants to bring in are very far away from the rural wage earners who are mostly agricultural labour. There is an urgent need to do more for them which the budget does not address at all. If nothing is done in this sphere, the resulting dualistic growth will further raise income and wealth inequalities in the country.

The budget refers to the Kisan Sanman Yojana, but data shows that after the first instalment (which also did not reach all the farmers) the coverage has reduced and today only about 25 % of the farmers have received the third instalment. Another problem with the policies is that the bottom 30 to 40 % of the population is more or less left out. The rural wages and particularly agricultural wages have declined leading to reduced consumption. However there is no move to raise their wages. They are virtually excluded from the development process.

The data presented in the budget raises some questions: the 3.8 % fiscal ratio today is not believable, as various estimates by experts have put the ratio at 4 to 5 %. Again, there is not much discussion in the budget on how money will be raised for the various proposals that have been listed. Merely mentioning borrowings in domestic and foreign markets are not enough. Again, the nominal GDP growth for 2020-21 is estimated by the Finance Minister at 10 per cent. This is far far above the rates estimated by the IMF, World Bank and other experts within and outside the country!

Finally, it will be appropriate to mention that some of the new programmes appear to be positive, provided of course that these programmes are implemented well. For instance, the promotion to start-ups, the MSME sector, and renewable energy, particularly solar energy are positive steps. So is the focus on tribal welfare and tribal development. Affordable housing is another good step which will be very beneficial. But it would have been much better if evaluation studies on their implementation in the past were done and then utilised in designing or expanding them. This could set right shortcomings in the earlier programmes.

To sum up, this budget is a missed opportunity! An opportunity lost in trying to reverse the on-going economic slowdown. An opportunity lost probably because the government is currently more concerned with its effort of trying to implement the CAA and NRC in the country rather than focus on the well-being of the people and healthy growth of the economy.

(Dr. Indira Hirway is Director and Professor of Economics, Center For Development Alternatives, Ahmedabad)