There was much drama involving economic data on the eve of the budget. Firstly, the remaining two independent members of the Statistical Commission resigned. Their exit made the constitutional body effectively vacuous, since the Chairman’s post was lying vacant since July. This is an apex advisory body to ensure that all the government’s data collection, collation, processing and dissemination is of high quality, objective, unbiased and statistically sound. The two members apparently resigned in protest over the government’s decision not to release the unemployment data. This was based on the maiden annual employment survey conducted by the reputed National Sample Survey Organization, and the report had been rigorously vetted by the Commission.

The main beneficiaries of the fiscal expansion in this budget, are small farmers and income-tax payers in the lower income categories, possibly the lower middle class from urban areas. Almost 12 crore farm households, which own small parcels of land will get an annual income of 6000 rupees per household. This is a fiscal injection of nearly 75,000 crore.

The suppression of the official report was awkward, because it was leaked out anyway, by a prominent newspaper. It showed that unemployment during 2017-18 was at a four decade high. And joblessness among rural youth had almost quadrupled. Added to this drama was the release of revised GDP data for the past four years, which showed substantial upward revision. So, the GDP data was showing strong performance, even in the year of demonetisation, despite weakness in employment, exports, credit off-take and private investment consumption. A third dramatic development was the announcement by the Congress party that it would introduce a Minimum Income Guarantee scheme if elected to office. Besides these immediate events, the ruling party was certainly mindful of the recent outcome from recent State elections.

With this backdrop it was natural to expect a pro-growth fiscally expansionary budget, which would be focused on addressing the rural and farm sector. And on this it has not disappointed. This was the last budget of the present government, just three months before national elections. Hence it had to be an interim one, if not just a vote on account. Such a budget could not include radical proposals of expenditure or changes in taxation, because this is the prerogative of the new government.

The main beneficiaries of the fiscal expansion in this budget, are small farmers and income-tax payers in the lower income categories, possibly the lower middle class from urban areas. Almost 12 crore farm households, which own small parcels of land will get an annual income of 6000 rupees per household. This is a fiscal injection of nearly 75,000 crore. Secondly all those with taxable income of less than 5 lakhs will have zero tax liability. Additionally for the salaried and pensioner class, the minimum exemption has been increased by 10,000 rupees. Together these two will mean an injection of almost 25,000 crore.

What the fiscal deficit ratio hides is the borrowing through the public sector enterprises. That number has grown from 78,000 crore in 2014-15 to nearly three times at 208,000 crore in the current year. The CAG report too had red flagged this fiscal smoke and mirrors. The international rating agencies too are worried about the stretched deficit ratios

Hence these measures amount to a first round impact of extra income of nearly 1 lakh crore, or 0.6 percent of GDP into the hands of low income people. This will go toward consumption spending, not into savings. To that extent it will have a positive direct impact on GDP and also an indirect one, through a second round multiplier effect. The introduction of an extensive social security for the unorganised sector is a step in the right direction. The government will make a matching contribution to the workers’ own, into their retirement pension.

Has this largesse jeopardised the fiscal arithmetic? Prima facie, not. That’s because the reported fiscal deficit ratio is 3.4 percent, just 0.1 shy of what was budgeted one year ago. How did the government achieve this? That’s because the direct tax collections have been healthy and have grown at a rate higher than budgeted last year. Indirect taxes, i.e. through GST have also grown faster. But what the fiscal deficit ratio hides is the borrowing through the public sector enterprises. That number has grown from 78,000 crore in 2014-15 to nearly three times at 208,000 crore in the current year. The CAG report too had red flagged this fiscal smoke and mirrors. The international rating agencies too are worried about the stretched deficit ratios, if State plus Centre is taken together, including the borrowing which lies hidden in public sector enterprises. The budget promises to bring the fiscal deficit ratio of the Central government down to 3 percent by 2020-2021. This looks like a tall promise, and given the track record in the past three years, it is unlikely to be achieved.

What would be the impact of fiscal imprudence? The total borrowing requirement will balloon. It is already budgeted at 7 lakh crore next year. This will cause interest rates to be pushed upward, hurting sectors like real estate, housing, retail and wholesale credit growth. It can also cause inflationary tendency.

What would be the impact of fiscal imprudence? The total borrowing requirement will balloon. It is already budgeted at 7 lakh crore next year. This will cause interest rates to be pushed upward, hurting sectors like real estate, housing, retail and wholesale credit growth. It can also cause inflationary tendency. Fiscal slippage is the perennial bugbear of successive Indian governments. The minister made a reference to the fiscal responsibility legislation, and the focus to move from deficit reduction to also debt consolidation. As for other macro numbers, the budget promises to increase overall spending slower than overall revenues. GDP is expected to grow at 11.5 percent, which translates into a real growth of around 7 or 7.5 percent. India will continue to remain among the fastest growing economies.

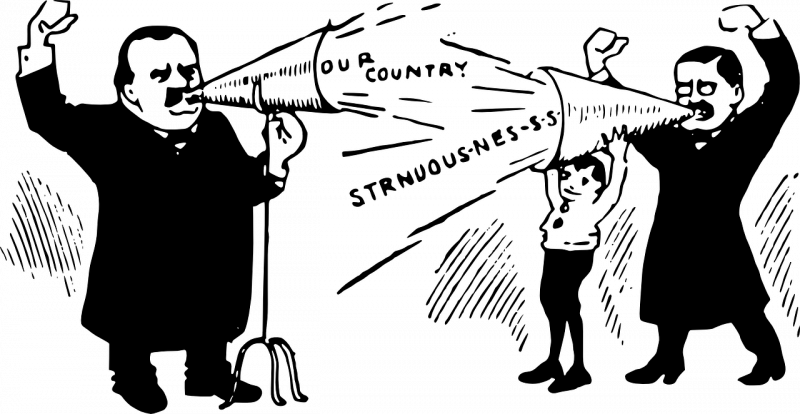

Then ten dimensions of the future vision for the country, was a most impressive list, except that it probably belongs in an election manifesto, not in an annual statement of accounts! Similarly the budget speech listed many achievements of the past four years, which reinforced the idea that this was definitely a pre-election budget. All eyes are now on the national democracy festival coming in three months.

(The writer is an economist and Senior Fellow, Takshashila Institution)